Manufacturing Expansion Continues but Slowing Down

Despite a slight dip in the PMI, the U.S. manufacturing sector expanded for the second consecutive month in February 2025. However, new headwinds emerged as businesses grappled with tariff uncertainties and softening demand.

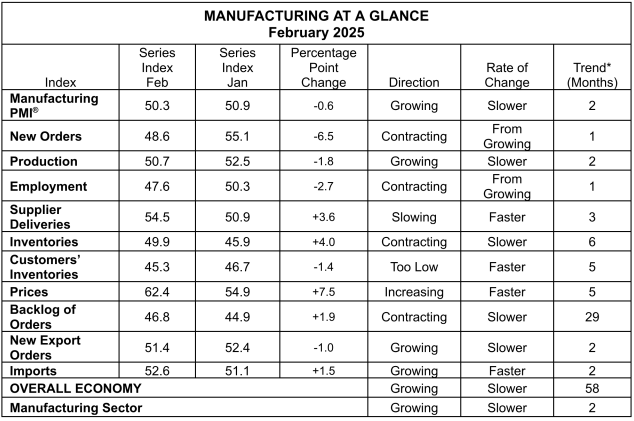

According to the latest Manufacturing Institute for Supply Management (ISM) Report On Business, the manufacturing PMI registered 50.3% in February, a decrease of 0.6 percentage points compared to January’s reading of 50.9%. A reading above 50% indicates that the manufacturing sector is generally expanding. This marks the second month of expansion after 26 consecutive months of contraction.

Key report’s highlights:

- The New Orders Index dropped into contraction territory, registering 48.6%, a significant decrease of 6.5 percentage points from January.

- The Production Index remained in expansion at 50.7%, although it was 1.8 percentage points lower than the previous month.

- The Employment Index moved back into contraction at 47.6%, down 2.7 percentage points from January.

- The Supplier Deliveries Index indicated further slowing, registering 54.5%, a 3.6 percentage point increase from January. A reading above 50% indicates slower deliveries.

- The Inventories Index contracted slower, registering 49.9%, up four percentage points from January.

- The Prices Index surged further into expansion, reaching 62.4%, a substantial increase of 7.5 percentage points compared to January.

- The Backlog of Orders Index remained in contraction at 46.8% but showed a slight increase of 1.9 percentage points from the previous month.

- New Export Orders and Imports continued to grow, registering 51.4% and 52.6%, respectively, although the growth in new export orders slowed.

Timothy R. Fiore, the ISM Manufacturing Business Survey Committee chair, commented, “U.S. manufacturing activity expanded marginally for the second month in February after 26 consecutive months of contraction. Demand weakened, while output stabilized and inputs contributed to PMI growth for the first time in several months.” He noted, “Panelists’ companies experienced the first operational shock of the new administration’s tariff policy. Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages, and manufacturing inventory impacts.”

Sector - specific insights

While chemical and petroleum products reported expansion, five industries reported contraction: computer and electronic products, furniture and related products, textile mills, nonmetallic mineral products, and machinery.

- Computer & Electronic Products: While this sector reported contraction overall, one respondent mentioned, “Tariff impact has been minimal to overall manufacturing and raw material supply. Limits on U.S. Government spending in key organizations like the Food and Drug Administration, Environmental Protection Agency, and National Institutes of Health are delaying some orders”. This industry also reported a decline in new orders and employment but growth in new export orders.

- Chemical products: One respondent noted, “The tariff environment regarding products from Mexico and Canada has created uncertainty and volatility among our customers and increased our exposure to retaliatory measures from these countries.” This industry was among the four largest reporting growth.

- Transportation Equipment: A company stated, “Customers are pausing on new orders due to uncertainty regarding tariffs. The administration has no clear direction on how they will be implemented, so it’s harder to project how they will affect business”. This was also one of the six largest industries and reported growth. However, this sector also reported slower new export orders and supplier deliveries.

Supply chain dynamics

The Supplier Deliveries Index indicated further slowing, suggesting that suppliers are having more difficulty meeting demand. Fiore stated this was partly due to “some pull - forward deliveries and discussions about who will pay for tariffs.” Nine industries reported slower supplier deliveries, including nonmetallic mineral products and textile mills.

The Inventories Index contracted, but the increase from the previous month suggests some recovery, potentially due to earlier deliveries requested in anticipation of tariffs and potential port stoppages.

The Customers’ Inventories Index moved further into ‘too low’ territory, registering 45.3%. Fiore indicated that this suggests a positive outlook for future production.

The Prices Index surged, increasing raw materials prices for the fifth month. This increase results in the “dramatic increase in commodity prices due to new and potential tariffs.” Commodities reported a rise in price, including aluminum, steel, and plastic resin. Electrical Components remained in short supply.

Challenges and outlook

Despite the continued expansion in manufacturing, the report highlights growing concerns about the impact of new tariffs on prices and demand. The drop in the New Orders Index suggests that the uncertainty surrounding tariff implementation is causing customers to pause on new orders. Maintaining growth while navigating these policy - driven challenges will be crucial for the manufacturing sector in the coming months.